Last December I posted a viral article where I -correctly- called out Celsius Network for being a massive Ponzi Scheme.

I now believe that the entire crypto lending industry is build around an astonishing and fraudulent playbook, the one used by Roger Ver a/k/a “Bitcoin Jesus” to gamble away $84m dollars of user funds from the crypto Lender CoinFLEX, leaving the company bankrupt and its depositors holding bags of bad debt.

What Roger Ver did is both smart and evil. In 2019 Roger Ver invested in CoinFLEX’s founding round and became a shareholder of the company. Unbeknown to CoinFLEX depositors Roger Ver wasn’t just a shareholder but also one of the company's largest debtor.

Just like all crypto lenders, CoinFLEX did not disclose any information about the counter-parties it was lending to. The lender only released this information after Roger Ver defaulted, and then publicly denied owing them any money.

The playbook used by Roger Ver is quite simple

Invest in a crypto lender.

Use your position as a shareholder/investor to take out massive un/under-collaterized loans at advantageous rates.

Degen gamble this money.

If everything ends well you made a lot of money and repay it. If your bet doesn’t pay out you just default on the lender and leave its depositors holding the bags.

Roger Ver is not the only one using this playbook

It will not come as a surprise to any one that 3AC was an investor in BlockFi and defrauded several projects the hedge fund invested in, but what really surprised me is that Sam Bankman-Fried appears to be using this playbook to an even crazier extend.

For those don’t knowing him, Sam Bankman-Fried often just referred as “SBF” is the founder of Alameda Research a “crypto hedge fund” and FTX a crypto exchange.

Having been into the crypto space since 2013 I never heard of SBF until 2019, when he became famous for being one of the most successful Bitcoin Arbitrage trader of all times. In an interview SBF explained what he did in simple words: “Bitcoin is trading at $10,000 on a US exchange, $11,000 on a Japanese Exchange, You take $10 million you buy BTC at $10,000, you sell at $11,000, you make a million dollars and we were able to do that every weekday”.

Having been in the crypto space even before SBF joined I can guarantee that such arbitrage opportunities did not occur every weekday as he claims, when they did the Bitcoin price difference wasn’t that big and often came with many catches ranging from the time it takes to send coins or fiat from one exchange to the other, the cost of the withdrawal/deposit/trading fees, withdrawal/deposit limits...

The only other successful Bitcoin arbitrage trader I have ever heard of is Stefan Qin, who later turned out to never have made any money with Bitcoin arbitrage but was actually running a ponzi scheme.

But that’s enough as an introduction, let’s look at how SBF and his companies FTX and Alameda are involved in the crypto lending space.

In March 2022 SBF’s hedge fund Alameda Research became Voyager’s lead investor. Voyager Digital unlike all the other crypto lenders is a publicly traded company and is therefor required to publish financial statements every 3 months.

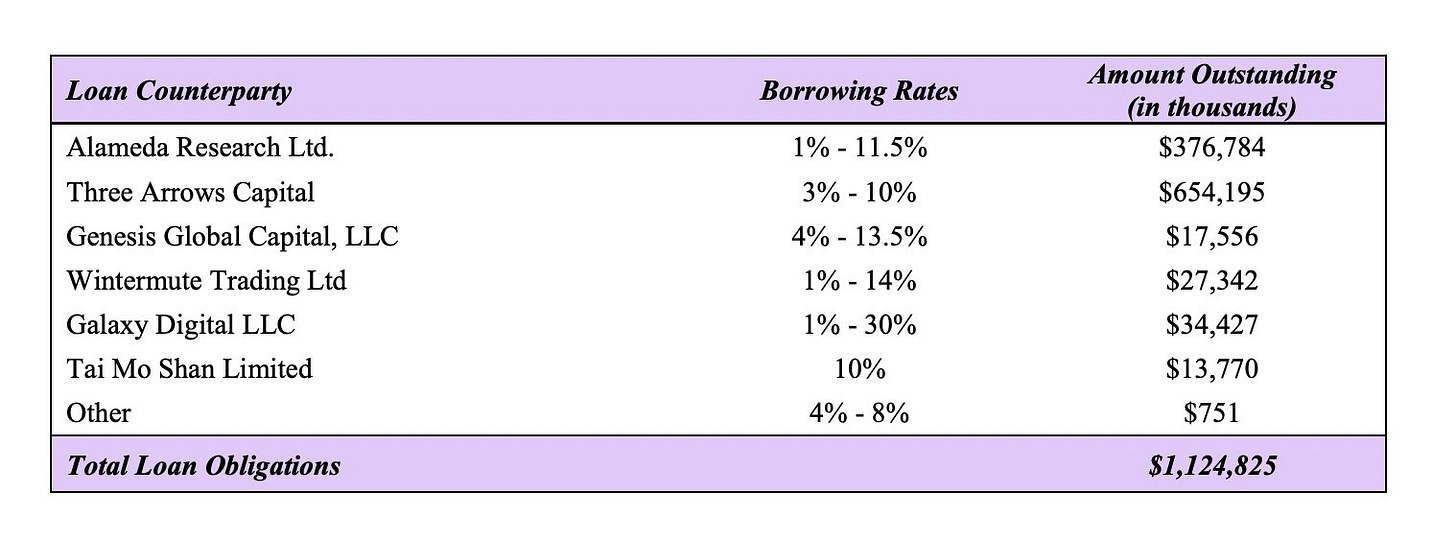

From those filing’s we know that Voyager was giving out ridiculously under-collaterized and therefor risky loans to their counter-parties.

When it became clear that the company had lost $650m to the now bankrupt crypto hedge fund 3AC, the company announced that SBF through its hedge fund Alameda Research provided them a credit line of the same amount. SBF became the white knight saviour and this gave many depositors the false believe that their funds were still safe with the company, they couldn’t have been more wrong, Voyager Digital filled for Bankruptcy soon after.

Sam Bankman-Fried’s credit line came with a catch. Voyager could only draw $75m a month from it and SBF could terminate it at any moment.

But what really came as a huge surprise to me was when Voyager’s chapter 11 revealed that SBF was not only an investor in the company but also its second largest creditor, owing the company $376m.

Even when the $75m withdrawn from the credit line are deducted, SBF still owes Voyager over $300m USD, and remember, from the SEDAR filings we know that Voyager was giving out largely un/under-collaterized loans, so it is unlikely that there is much if any collateral to back up this loan. Therefor SBF is not the white knight every one hoped for but a debtor that still hasn’t repaid its loan to Voyager and its thousands of retail depositors.

A similar scenario is currently playing out with BlockFi on which SBF currently has an option to acquire after he provided them with a credit line as well. To this date it is unknown if SBF is a debtor to the company and if so, how much he owes them.

With all those elements it seems to me that SBF is unwilling or more likely unable to repay the loans he/his companies have taken out from these crypto lenders and therefor is trying to save them as a bankruptcy might force him to meet his obligations.

Just as a bonus I also need to mention that FTX (SBF’s exchange) also offers an earn lending program that let’s you earn 5-8% APY on every coin or token, including Bitcoin! Those monies are then likely used by his Hedge Fund Alameda to speculate on the market. Those yields are absolutely unsustainable.

Tether also took unfair advantage of Celsius Network depositors

Tether, the largest USD stable coin and infamous for never have been able to release an audit proving the existence of its reserves appears to also have played the Roger Ver playbook but in another way.

Tether was one of Celsius Network’s lead investors and later became a depositor earning interest on USDT they lend to the company. It is unclear what the exact amount was, but the speculated amount ranges between $1bn to $2bn.

However there was a catch that played in Tether’s favour, unlike retail depositors who where unsecured creditors to the company, Tether was given Bitcoins as a guarantee.

When Celsius shutdown its withdrawals Tether liquidated the Bitcoins and moved away without enduring any losses, a luxury the retail depositor did not have.

This is a perfect example on how large investors used their position and influence to get unfair advantages over smaller retail investors.

Conclusion

Since last year when I started researching on the crypto lending industry I have been asking over and over many companies such as Nexo, Celsius, Voyager and BlockFi to provide me with very basic information regarding the state of their finances and details on the counter-parties they were lending to. NONE fulfilled my request, not even partially.

Crypto lenders have failed to disclose the risks and the multiple conflict of interests that plagues them and as a result many people will lose a lot of money.

I do expect and hope that the regulators move in and go after the big players such as Tether, Roger Ver, 3AC, SBF, Voyager, Celsius… who have taken advantage of retail depositors to enrich themselves.

You wrote a great article and I'm very interested to read more from you and your researches.

What do you think about Binance?