This time I decided to focus on Voyager Digital. The company offers a service very similar to Celsius Network with almost identical yields.

But unlike Celsius it is a public company and therefor is publishing audited financial statements on the SEDAR website, the Canadian equivalent for Edgar in the US.

The main idea, was to check if I could find any information regarding the identity of their mysterious institutional borrowers, the ones no crypto lending company is willing to name.

Unfortunately Voyager's financial statements do not contain the name of these institutions, they are just referred as "Counterparties A,B,C,D...".

Fortunately the financial statements include some details such as: the counterparty's geographic location, the interest rate interval and the amount of funds Voyager has lend to them.

This is not much but was enough to identify Counterparty C as Celsius Network.

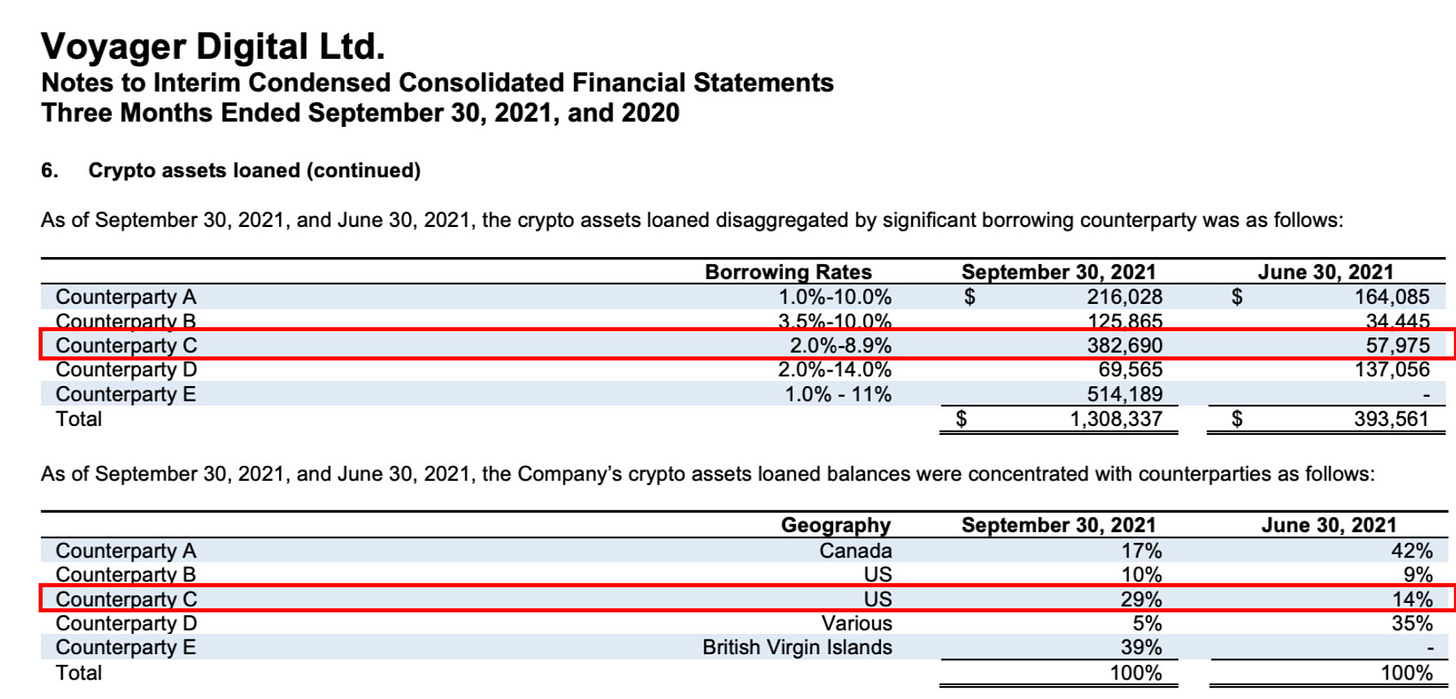

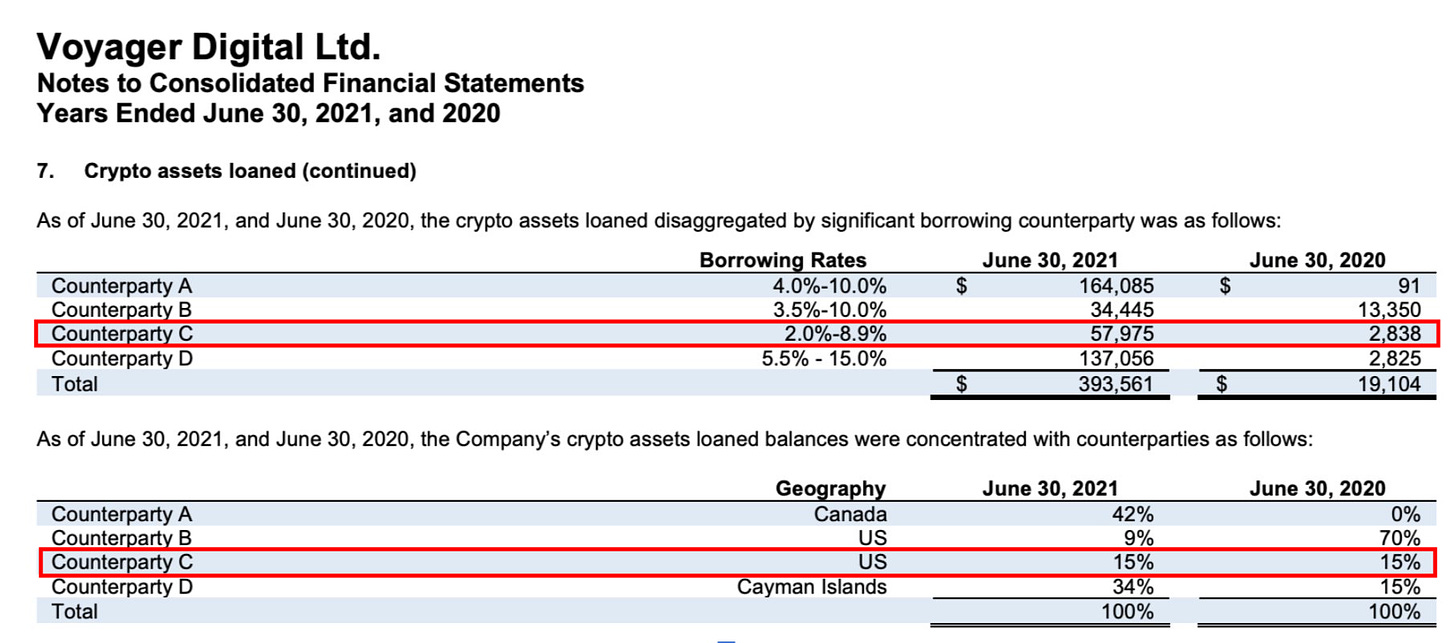

Bellow I included a screenshot of the three financial statements that include information on Voyager’s counterparties. I have highlighted Counterparty C (Celsius Network)

Statement 1

Statement 2

Statement 3

The Evidence:

From the statements it appears that:

Counterparty C has moved from the UK to the US between March 31 and June 30 2021. This matches Celsius’s move from the UK to the US in June 2021. Details here.

Counterparty C was paying 2-8.9% interests in June and September 2021 and 2-10.5% in March 2021. The 8.9% and 10.5% rates match exactly the rates Celsius Network’s was providing on USD stable coins at those times to its retail customers.

Voyager's response

I first contacted the Voyager's Investor Relations because I was suspicious that Counterparty E could be Bitfinex/iFinex/Tether.

Their response:

“We do not disclose our lending partners for competitive purposes but I can confirm its not any of those.”

When I later asked the same about Counterparty C being Celsius Network the response was:

“We do not comment on counter-parties beyond what is publicly disclosed in our filings as required by reg FD.”

The fact that Voyager denied Counterparty E being Bitfinex/iFinex/Tether but did not deny Counterparty C being Celius is even further evidence.

Why this is a big issue

Celsius is banned from operating in several states, including: Kentlucky, New York and Texas.

It appears that Voyager is offering their service there, which could be “problematic”.

Voyager Digital has stated regarding the counterparties:

“The Company limits its credit risk by placing its digital currencies and fiat on loan with high credit quality financial institutions that are believed to have sufficient capital to meet their obligations as they come due and on which the Company has performed internal due diligence procedures.”

But the fact that they have chosen Celsius Network as a partner raises many questions regarding the quality of their due diligence procedures and their counterparty picking.

EDIT:

I was made aware of this 2019 press release which is further evidence:

Would you consider doing a follow-up on Voyager loaning money to Celsius? With Celsius now not allowing withdrawals, Steve Ehrlich is insisting that they zero exposure to Celsius. I don't believe him and believe he's dancing around using semantics.