With over $20b in assets under management Celsius Network is the biggest centralised lending platform in the crypto space. Its flagship product: 10 to 12.68% annual returns on USD stable coins and this with little to no risks.

Sounds too good to be true? It certainly is!

Celsius outcompetes traditional finance by a factor 20x to 100x

The obvious question everyone should ask theirselves, is how can Celsius achieve such high yields when at the same time you get around:

- 0.50% APY on your USD savings account.

- 0.15% APY on USDC on Coinbase.

- 8% APY if you invest in CCC rated junk bonds.

When asked how Celsius outcompetes traditional finance their answer often includes:

"Banks are not your friends", "Banks generate those yields but they keep it all for themselves", "We give back 80% of what we make back to the community", "When I was a child banks used to also give you 10%, now they have figured out that they don't need to", "If you look at their earnings report you will see that they also make 10% ROI per year", "We are the real robinhood".

A classic Ponzi narrative…

So, how does Celsius generate these yields?

Celsius is very vague when asked to explain how they magically create double digit returns, but they have repeatedly evoked these 4 methods :

1. Institutional borrowers

According to Celsius most of its income comes from institutional borrowers paying between 7 to 15% interest (Source)

Celsius has never revealed the name of a single of these institutions nor their creditworthiness.

While Celsius's CEO Alex Mashinsky has assured that these loans are fully collaterized, his former CFO - the actual one is suspended after having been arrested a few weeks ago on fraud and money laundering charge - has stated that this is not the case (Source).

Also it is unknown what the collateral exactly is nor if these institutions could be a related entity. In other words: Is Celsius lending money to itself?

2. A retail lending service

It is possible for customers to take out USD stable coin loans from Celsius, under the condition that they provide a Bitcoin or Ethereum collateral of at least twice the value of the loan.

The interest rate for these loans is between 1% to 8.95%. Less than what they pay back to their “investors” (10-12.68%).

Yet Celsius claims to be profitable on this by “rehypothecating” the collateral.

This practice is extremely risky and has been responsible or at least partially responsible for the subprime crisis. But even with rehypotication it is highly questionable if Celsius could be generating a profit here.

3. DeFi investments

Celsius claims to generate profits by placing crypto assets in DeFi protocols.

It is highly unlikely that this is the case.

First the yields you get on most DeFi protocols are lower than what Celsius is paying.

For example this research has revealed that Celsius placed almost half of its ETH holding with Compound and AAVE, generating less than 1% APY. Meanwhile they pay out 5.26-6.72% APY on ETH to their retail customers.

Second, investing in DeFis carries risks, for example the risk being scammed or hacked. Last week alone Celsius lost around 900BTC ($50million USD at the time) in the BadgerDAO hack. They tried to first cover this up, but eventually had to admit to the loss after growing evidence were found.

According to some sources, this might not have been the first time that Celsius experienced such a massive loss in the DeFI space.

4. A mining operation

Celsius has recently announced that it will invest $300million USD in Bitcoin mining. Not much is known about it yet. But it shows one thing: Celsius is trying a lot of different methods to be able to generate some profit and so far it doesn’t look like it is very successful at it.

What does their Audit say?

With over $20billion in assets under management you would expect that Celsius has been audited through-fully by an auditor.

This is not the case! Celsius only did a “Zero-Knowledge Audit” with a small crypto accounting startup called Horizen Labs (Source)

Their “zk Audit” limits itself to the publicly available information on the blockchain.

This means that at no time “Horizen Labs” went to ask Celsius any information on who their institutional borrowers were and could have verified their existence and creditworthiness.

A CFO arrested on Money laundering, fraud and tax evasion charges

3 to 4 weeks ago Celsius’s CFO Yaron Shalem got arrested on money laundering and fraud in what is known in Israel as the Moshe Hogeg case.

Celsius knew of the arrest, and tried to cover it up by deleting comments or postings on Reddit asking for confirmation. Only a week later they came up with a very vague statement that read:

We were recently made aware of a police investigation in Israel involving an employee. While this is in no way related to the employee’s time or work at @CelsiusNetwork, the employee was immediately suspended. We have also verified that no assets were misplaced or mishandled.

Additionally, web archive data shows that Moshe Hogeg - a serial entrepreneur who was actually more of a serial scammer - was an early day advisor of Celsius Network and that Celsius’s CEO Alex Mashinsky had himself been an advisor in one of Hogeg’s scams.

An Ex-Pornstar as the head of institutional lending

Given that institutional lending is Celsius’s main source of income the “head of institutional lending” role must be a very important one.

Until mid-2020 this position was occupied by a 24 year old ex-pornstar with no relevant prior work experience.

I will not name her here as I believe that she is a victim here. Ponzi schemes and other frauds often use naive or under-qualified people in high ranking positions, - the kind of people that don’t even know what a ponzi scheme is - so that they can make them do/sign anything without asking questions.

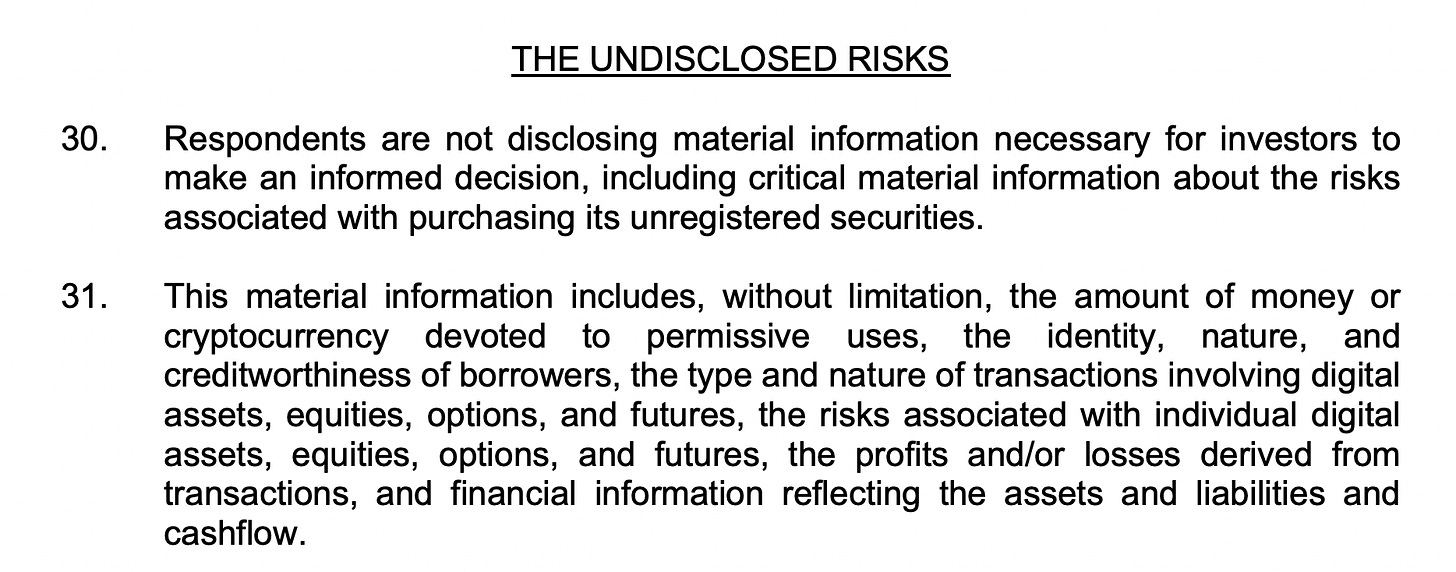

Regulators are unhappy

To this date regulators in New Jersey, Kentlucky, Texas and New York have issued cease and desists against Celsius Network.

It seems that one of their main source of concern is as follows:

Alex Mashinsky the “Inventor of VOIP”

Many claims made by Celsius’s CEO Alex Mashinsky about his past achievement are exaggerated and misleading.

His main claim of “inventing” VOIP is not true. When searching for the “inventor” of VOIP his name never appears.

While it is correct that he had a patent describing a VOIP use case and that he worked for a company in the early years of VOIP, claiming to be its inventor is hugely exaggerated. It is a bit like claiming to have invented the internet because you were one of the first having a website.

In a recent interview (December 1st 2021) he stated:

“States and other regulators have looked into Celsius, they all came back thumbs up, no problem we didn't find anything….”

Which is in total contradiction with the reality as described in the section “Regulators are unhappy”

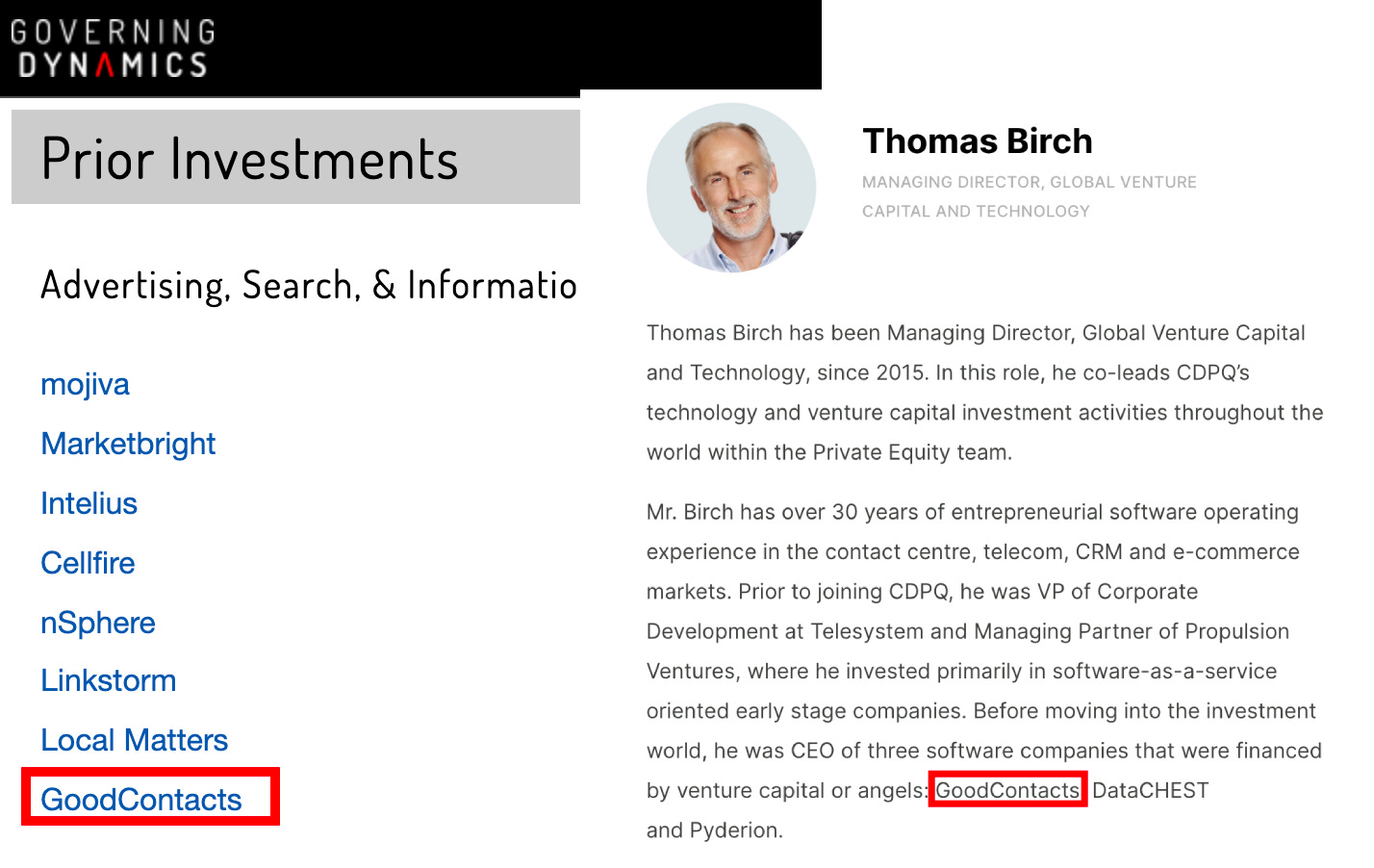

“We have the biggest Canadian pension fund as an investor”, so it must be legit

Celsius’s first investors were Governing Dynamics, a VC owned by Alex Mashinsky and that he used to invest in his own companies and Tether, a stable coin operator under scrutiny by regulators for possibly running a massive ponzi scheme itself.

But in their latest fund raising they were able to attract two big names. West Cap and CDPQ.

The CDPQ is the second largest Canadian pension fund. So why did they invest?

According to one of my sources Alex Mashinsky has once said: “We got the CDPQ investment because we know someone there”

And indeed, when looking at CDPQ’s management team a link between Alex Mashinsky and the CDPQ appears.

Thomas Birch, one of CDPQ’s managing directors was previously the CEO of GoodContacts, a company Alex Mashinsky’s Governing Dynamics VC invested in.

“We have many competitors offering exactly the same”, so it must be legit

This is one of Celsius’s CEO Alex Mashinsky’s latest argument to disprove ponzi scheme allegations.

He is right in the sense that there are indeed a dozen Celsius competitors offering exactly the same rates and with nearly identical websites.

The catch?! Fraud attracts fraud. When Ponzi started to issue Ponzi notes a few other fraudster rapidly figured out his scheme and set up a clone right next to his offices. Ponzi knew they were also a fraud but could not do anything about them.

I analysed Celsius’s competitors and they not only share Celsius’s rates but also:

None of them is audited

None of them gives details on how they generate the returns

Many are also getting cease and desists from regulators

The case of Aubit a.k.a Freeway speaks for itself.

In a video tweet they stated:

“0.098% rewards per day was sustainable and it was fine […] but it sounds too good to be true […] it can’t possibly be real […] that was too high, we should have set 12%”

- Aubit now offers rates similar to Celsius.

Aubit’s previous 0.098% per day results in 43% APY!!

Some providers such as Nexo claim to be “audited”. But this is not correct!

Very visible on its website Nexo displays “Audited by armanino”

However when clicking on the link and reading the document it appears that this is NOT an audit but an AUP (agreed-upon procedure).

An AUP is in no way comparable to an audit, as no claims are verified.

Here are some quotes from their AUP:

“Obtain the total outstanding customer loan balance in USD directly from Nexo via API.”

“Obtain a detailed listing of customer deposits in nominal digital and fiat assets directly from Nexo via API”

The entire AUP is based on data that Nexo provided, mainly through an API.

In this video (Minute 16:52), one of the co-founders of Nexo and Armanino admit that Nexo is not “really” audited.

Red flags summary

I will now let you conclude for yourselves what is going on here.

Not financial advice!

7 to 15% interest institutional borrowers paying between 7 to 15% interest - this is total BS - I am HNWI and I get money thrown at me in USD 2 to 3% max a year - In Euros I can get money for even less. So what Institution pays more than I would pay? Ones with crappy credit - higher than junk bond status. The counterparty risk is off the scale

Lmao FUD